- The Sideline

- Posts

- 🏴☠️ The Client You’d Never Fire Could Destroy Your Exit

🏴☠️ The Client You’d Never Fire Could Destroy Your Exit

How a founder’s most loyal client capped the company’s exit multiple

Early Access Note

We just launched the first version of our business valuation dashboard and are testing it with a small group of founders. If you want to see how buyers evaluate valuations in real time, you can request a private walkthrough.

Today's issue covers one of the key inputs we built it around.

A Story…

Last week, I was on a call with a founder who sounded proud and uneasy at the same time.

I was on a call last week with a founder who sounded confident and uneasy at the same time.

“We’ve got a great client. Long relationship. About 45 percent of our revenue.”

Then he added, almost under his breath,

“I know buyers don’t love that.”

He was right.

And it had nothing to do with loyalty or performance.

Best Links

💰Sales: AI is compressing execution, inflating risk, and shifting value toward defensibility, judgment, and trust, which is why the best sales conversations now focus less on tools and more on who you trust when the tools are wrong. Read about it in the Middle Market Growth Report (Link).

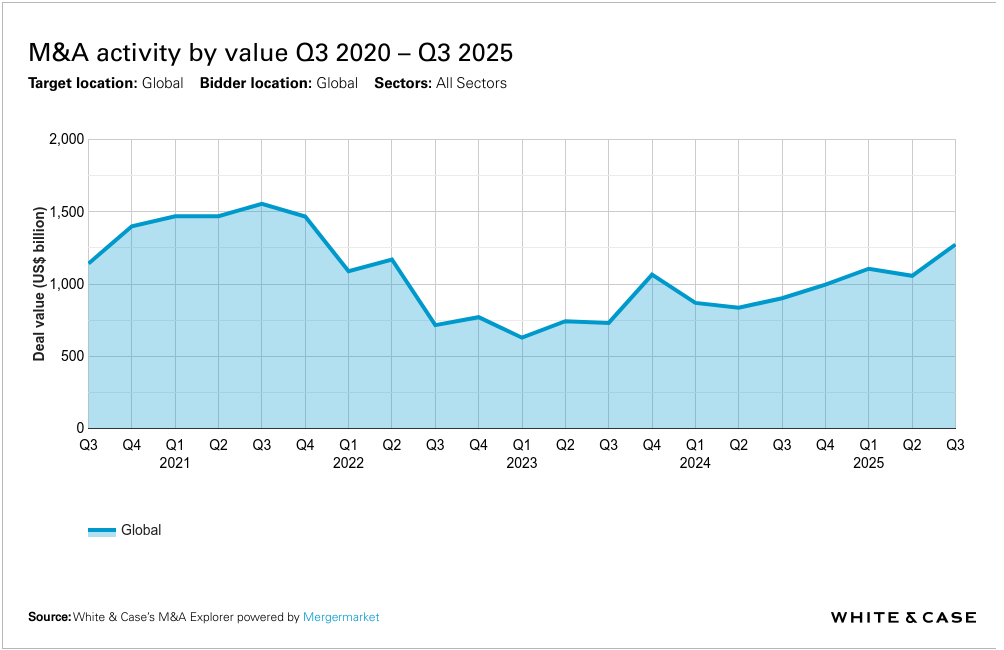

🌟 Industry Trends: Deal activity looks in shape to rocket-ship in 2026 as interest rates go down and uncertainty around AI normalizes. REview M&A Explorer’s global M&A activity (Link). Most active sectors are tech representing 13% of transaction volume, with construction at #10 ~0.8%.

🍏 Extra Credit: No asking price, $1.2M cash flow, decades-old client relationships…but is this deal as clean as it looks? We break down what every buyer will check first. (Link To Watch Video)

Here’s what founders miss about client concentration.

Buyers don't ask, "Is this client loyal?" They ask, "What happens if they leave?"

And then they price the answer in.

I've watched buyers do this in real time. They haircut projected cash flow. They lower the multiple. They add earnouts or holdbacks. Or they walk entirely.

Not because the business is bad. Because too much value walks out the door with one relationship.

The founder still sees a strong company. The buyer sees fragile cash flow.

Those are two very different valuations.

Client concentration changes how buyers underwrite risk.

When one client is too large, buyers assume revenue is not durable, pricing power is limited, transition risk is high, and the founder is more embedded than they admit.

That shows up directly in the offer.

Same business. Same EBITDA. Lower multiple.

Why? Because buyers pay for what survives without you and without any single customer.

Concentration isn't a red flag. It's a math problem.

And math always wins in an exit.

If you’re thinking about an exit someday, do this now:

Stress test your largest client.

Ask yourself, "If they left tomorrow, what multiple would a buyer apply?"

Translate concentration into dollars.

Rough rule of thumb: every client over 20% costs you leverage in negotiations. That leverage shows up as lower price, worse terms, or both.

Prove replaceability.

Build evidence that revenue is repeatable elsewhere. Proof means contracts, pricing consistency, and diversified pipelines.

You don't need to fire your biggest client.

You need to show the business doesn't depend on them.

Before You Go

If you want help understanding what customer concentration means for your valuation, we're doing private demos right now. Just hit reply.

See you next week.

-Kinza

|

|

Reply