- The Sideline

- Posts

- 🏴☠️ 5 Levels of Backlog That Make Or Break Valuation

🏴☠️ 5 Levels of Backlog That Make Or Break Valuation

(and what to do about it)

This week in Chief Rebel news… why the real leverage in your business is not cash, not headcount, not workload. It is backlog quality.

Two weeks ago, a friend called and wanted my advice on a company he wanted to acquire. He sounded confident, “The seller says the backlog is super strong.”

So I asked him a few questions…and it ten minutes, there was no backlog.

The backlog showed six figures.

But after a few conversations with the seller, the real number was $80K.

Best Links

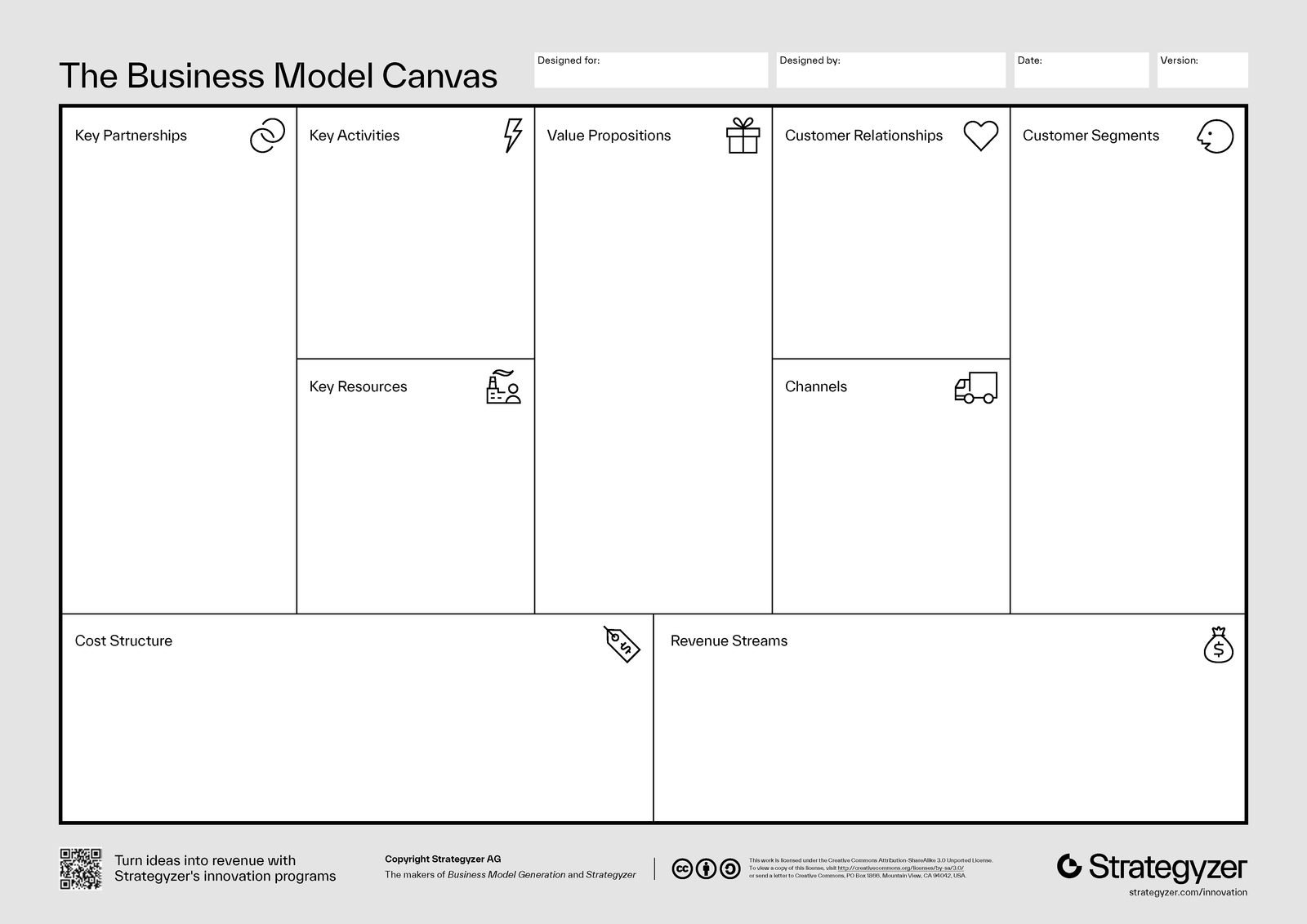

Clients hire me for exit prep, but the Business Model Canvas forces the truth about how the business actually works. It exposes assumptions long before a buyer does — which is exactly when you want to catch them. (Link)

David Senra on doing too much — a reminder that the best business owners say “no” to a lot (Link)

Vibe coding just got added to the dictionary. If you haven’t tried your hand at Replit or reviewed your org’s repeatable processes, it’s time to. (Link)

How lenders view risk in small business acquisitions (Link)

Why Backlog Is the Real Valuation Test

Here is how the conversation went.

He said, “They told me these were booked.”

I said, “Booked means signed and paid. What you have is a list of people who expressed interest.”

He said, “So what is this actually worth?”

I said, “Less than you think. And less than they want.”

Most founders confuse a busy whiteboard with a strong backlog.

But quality backlog tells a buyer five things:

Your sales process is real, not verbal.

Your pricing is firm, not negotiable.

Your cash flow is forecastable.

Your team can deliver.

Your business is not dependent on hope.

Weak backlog tells a buyer something else:

Customers abandon projects.

The founder is the only closer.

Collections are inconsistent.

Deposits are not enforced.

Forecasts are fiction.

The buyer on the call said it plainly:

“This just changed my view of the entire business.”

Backlog quality is a valuation lever.

Here’s How to Rebuild the Truth

Level 1: Signed and paid. This is the only number that counts.

Level 2: Signed but no deposit. Possible revenue. Not guaranteed.

Level 3: Verbal yes. Zero value at this point.

Level 4: Proposals sent. Forecasting tool, but not backlog.

Level 5: Dead leads. Deals the founder refuses to admit are dead.

When we recategorized the company’s backlog into these five levels, the truth became clear. The buyer told me, “I would have overpaid.”

This is why I tell founders the same thing I told him:

If your backlog cannot survive diligence, your valuation will not survive negotiation.

Action Plan: Your 3 Step Backlog Reset

Step 1: Rebuild your entire backlog using the 5 level ladder above.

This is the same backlog buyers ask for once under contract. If these contracts don’t land, it will hurt your valuation.

Step 2: Assign a confidence score to every deal.

Green is high probability. Yellow needs tightening. Red gets deleted (or appropriately noted if your close rate is lower than 20% — this suggest opportunity to improve conversion).

Step 3: Clean your next 90 days.

If it is not contracted and paid, fix it or replace it.

Thirty minutes of honesty gives you twelve months of peace of mind.

Before You Go

Most SMBs never slow down long enough to map how their business actually works or why their backlog keeps slipping through their fingers. When you skip that step, the business always feels harder than it should.

If you want help, we’ll walk you through both your current state and your future state, and show you exactly how to make your backlog something a buyer cannot poke holes in.

See you next week.

-Kinza

|

|

Reply